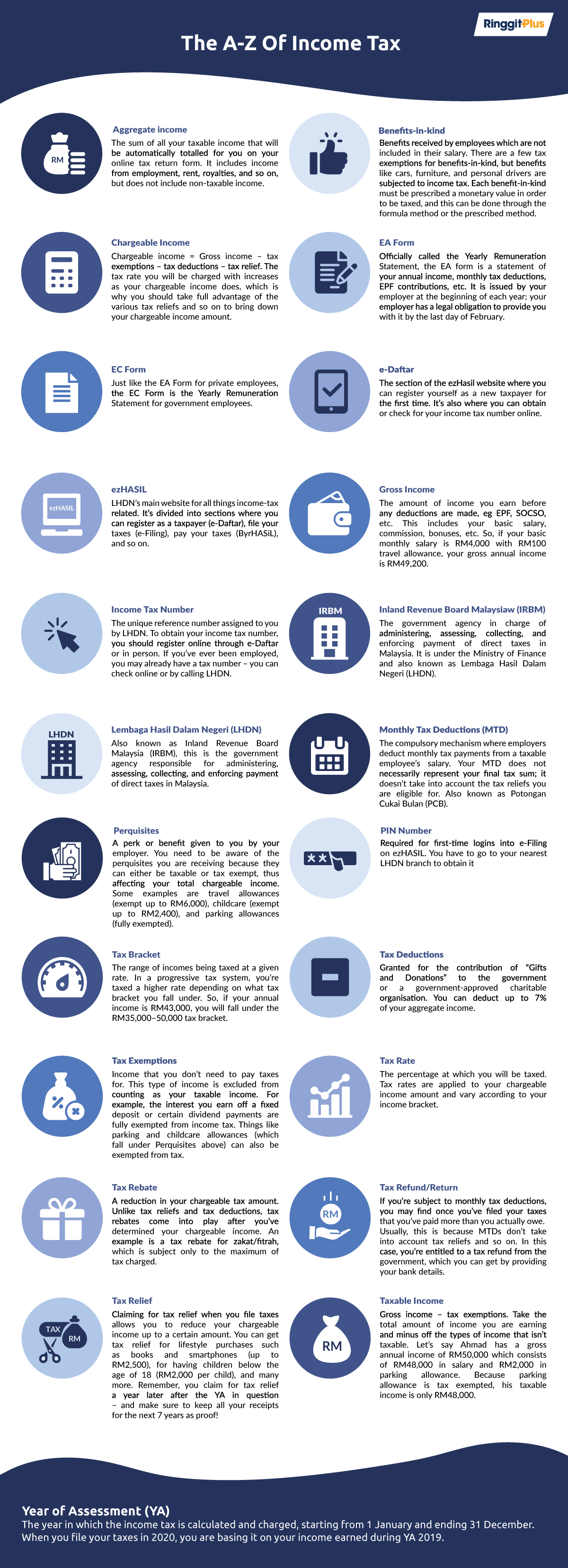

annual return filing fee tax deductible malaysia

The government had proposed to implement a new GST return system. 15 Lakh us 80C of the Income Tax Act 1961.

Tax Deduction Of Secretarial Fees And Tax Filing Fees

Must contain at least 4 different symbols.

. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. If a tax payment is delayed but paid by the deadline for filing the following years income tax return a penalty equal to 375 percent of the unpaid income tax is due plus interest of. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

Distinctive element descriptive element and a legal ending. Hey there I just have a question about filing your tax returns. OR FEE -- Annual duties payable for the privilege of carrying on a.

Be informed and get ahead with. Online trade commissions are 000 for US. Stocks options if approved mutual funds exchange-traded funds ETFs bonds and CDs are available in most TD Ameritrade accounts.

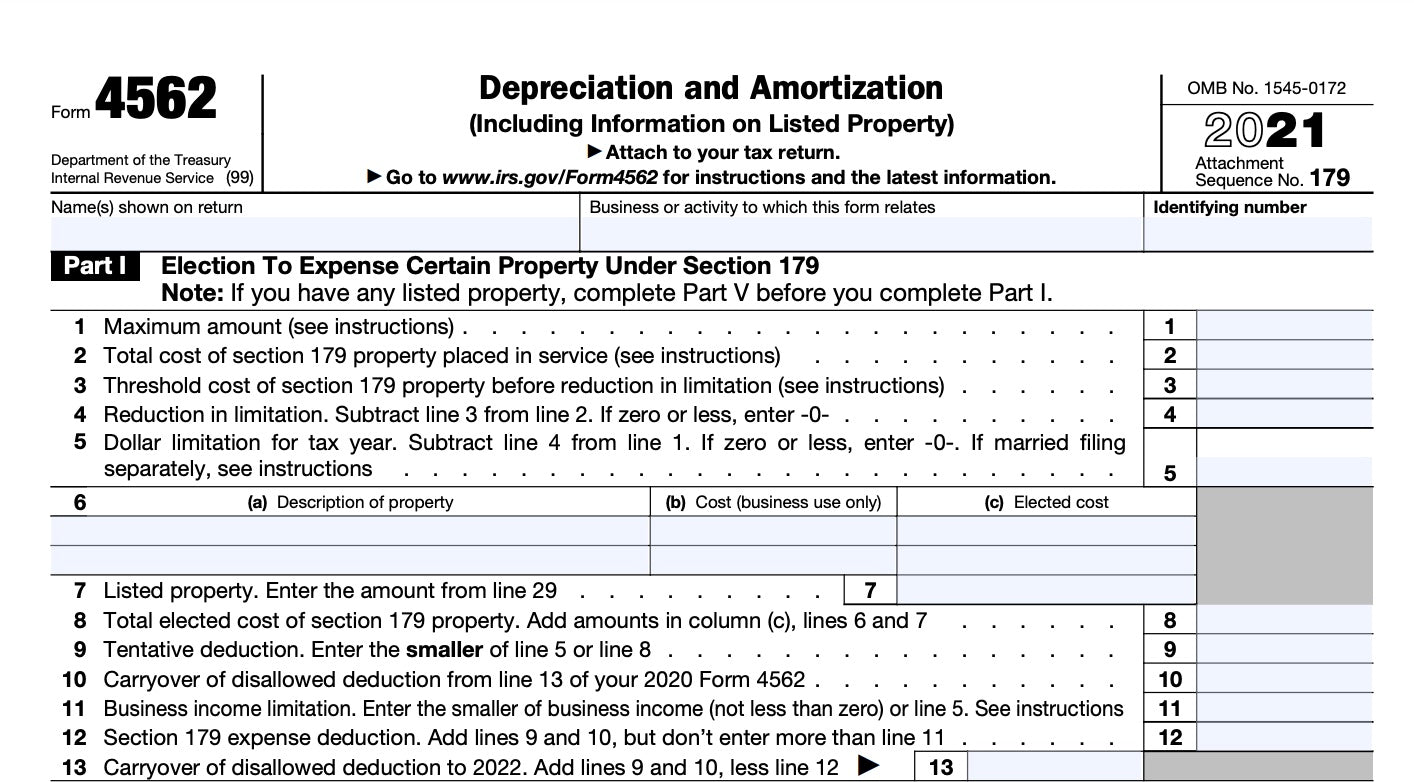

Unused amounts of this special form of capital loss which can be used only for this purpose may be carried back three tax years or carried forward indefinitely. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e. Tax-exempt organizations whose annual gross receipts are normally less than 50000 are eligible to file instead of Form 990 or Form 990-EZ.

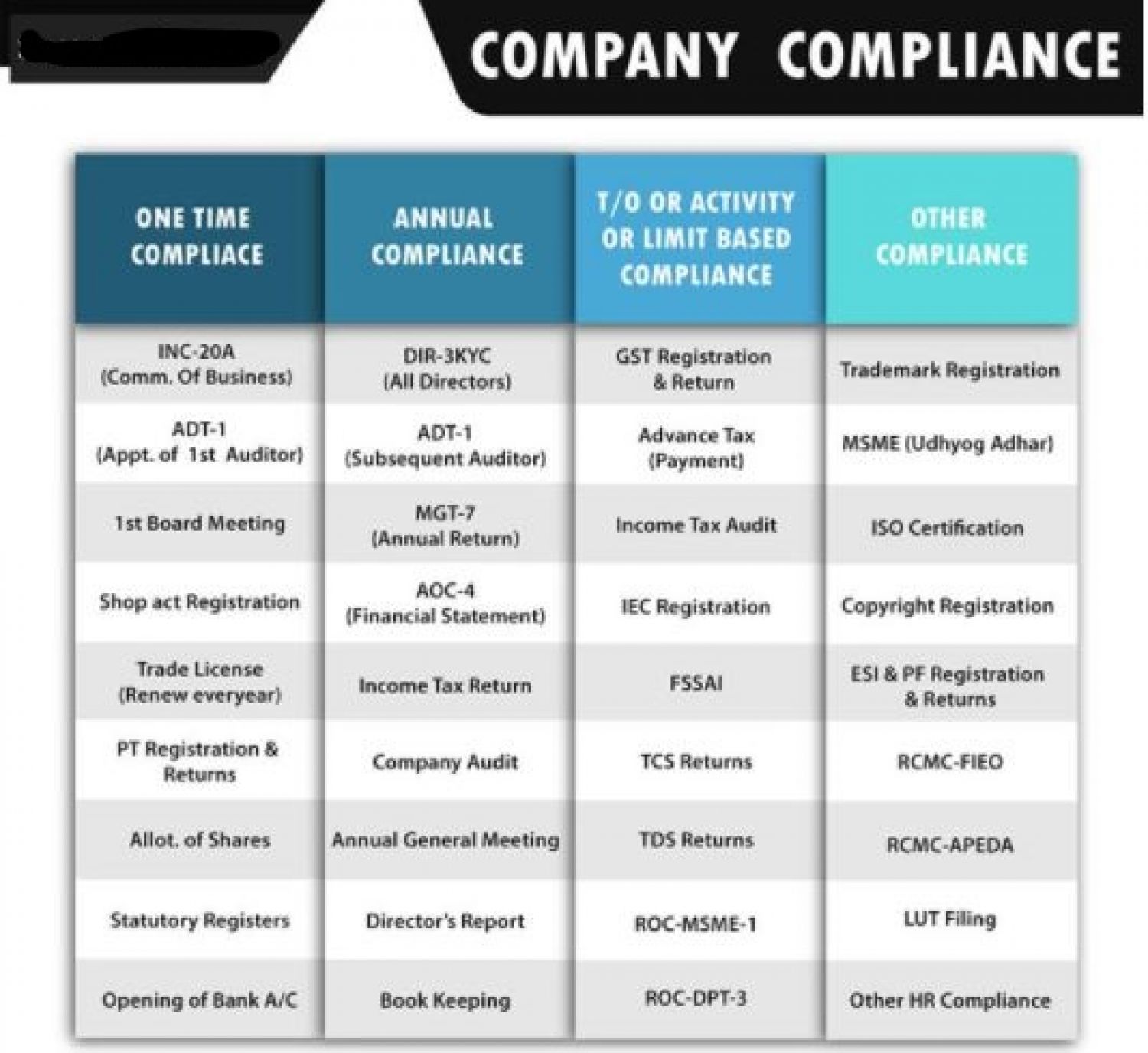

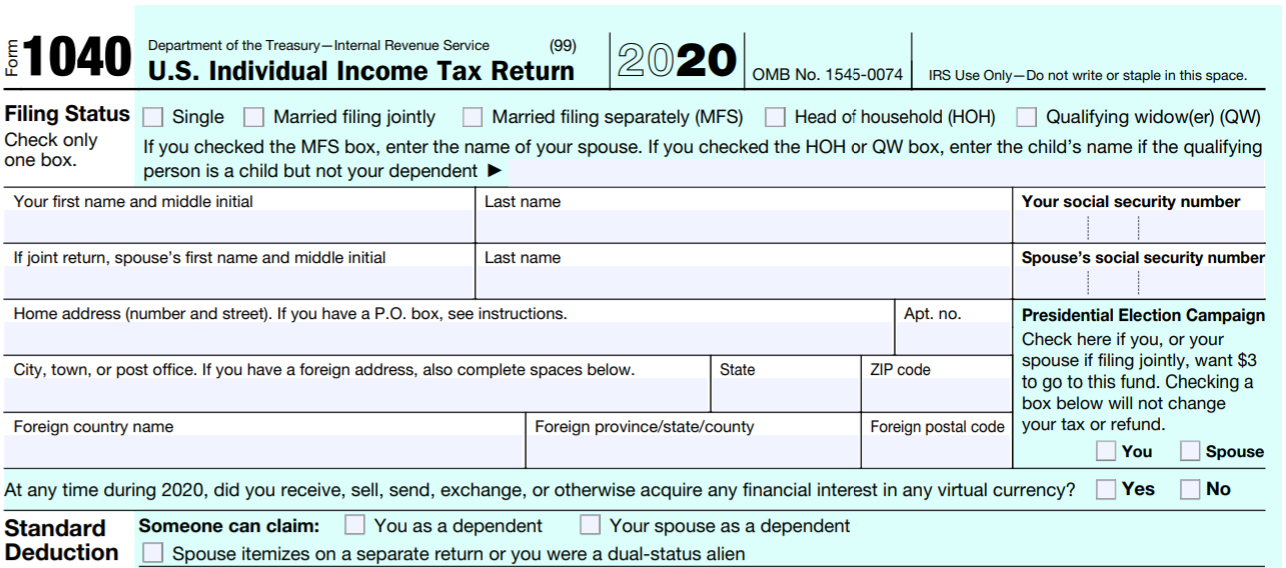

1040 If you file a return let me give you a free. The result shall be the tax to be deducted. Secretarial fee charged in respect of secretarial services to comply with the statutory requirements under the Companies Act 2016 is deductible.

301116 was a form of the poll tax. 6000 would be allowed as a deduction if next year on the directors remuneration tax is deducted ie FY 2020-2021 at the time of payment and the amount is paid to the government. The tax rebate on medical treatment special needs and parental care has been increased from RM5000 in 2021 to RM8000 in 2022.

Select the TD Ameritrade account thats right for you. Applicable tax-exempt organization For purposes of this subchapter the term applicable tax-exempt organization means any organization which without regard to any excess benefit would be described in paragraph 3 4 or 29 of section 501c and exempt from tax under section 501a and. Russian property tax is paid by the owners at a maximum rate of 2 of the value of the property depending on the value of the property as determined on 1 January.

Form GSTR-3 a monthly tax return by the 20th day of the succeeding month. Interest royalty contract payment technical fee rental of movable property payment to a non-resident public entertainer or other payments made to non-residents which are subject to Malaysian withholding tax but where the withholding tax was not paid. This tax is then divided by the number of payments.

Income Tax Benefits on ULIP On top of the insurance and investment benefits Unit Linked Insurance Plan also offers income tax exemption benefits for maximum of Rs. In general expenses incurred in the ordinary course of business are deductible subject to the requirements for documentary support. 6 to 30 characters long.

ASCII characters only characters found on a standard US keyboard. Form 990-N e-Postcard Organizations who have filed a Form 990-N e-Postcard annual electronic notice. A 065 per contract fee applies for options trades with no minimum balances on most account types.

Exchangelisted stocks ETFs and options. Malaysia Suspends Issuing of Online Visas For Indian Travellers. While calculating the business income for the FY 2021-2022 the amount of Rs.

A corporations disbursements of more than KRW 30000 for goods or services provided are required to be supported by qualifying evidences such as credit card sales vouchers cash receipts tax invoices and those vouchers. One of the earliest taxes mentioned in the Bible of a half-shekel per annum from each adult Jew Ex. 21102022 - Sequential filing of GSTR-1 filing of GSTR-1 before GSTR-3B on GST Portal 1.

In general you pay Russian property tax annually as part of your tax return application. It is an example of the concept of fixed tax. The HDFC ERGO Annual Multi-trip Insurance is tailored just for you so you can secure multiple trips under one comprehensive insurance plan.

ULIPs allow tax is invested in a ULIP is deductible from ones reducing the money owed to the government by way of income tax. The annual amount of tax is calculated at the progressive tax rates prevailing. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

01 percent per year starting from 1 January 2017. Lower than 300000 p. Lodgement of annual return and Financial statements.

Secretarial and tax filing fees for YA 2020 and 2021 are only tax-deductible when the fees are incurred and paid. Individual tax relief up to RM1000 for the purchase of COVID-19 detection test kits for self spouse and child RM1000 tax rebate for vaccination expenses for self spouse and child. Annual returns filed with the IRS which are available for public inspection.

All corporations must have a distinctive element and in most filing jurisdictions a legal ending to their names. The auditor will actually assess whether the expenses amount and nature of the expense booked by the company are reasonable and justifiable to be tax-deductible. A registration fee is due which is usually between 25 and 1000 depending on the state.

Poll taxes are administratively cheap because. To which a taxpayer complies or fails to comply with the tax rules of his country for example by declaring income filing a return and paying the tax due in a timely. If you intend to claim certain expenses against your tax it is advisable that you bring this up to discuss with your tax accountant.

A poll tax also called a per capita tax or capitation tax is a tax that levies a set amount per individual. The Central Government has amended Section 37 Section 39 of Central Goods Service Tax Act CGST 2017 vide Notification No. The government has notified a requirement to file monthly Form GSTR-3B to be filed by the 20th day of the succeeding month.

An income tax return needs to be made to the tax office by the 31st March for the prior tax year. Form 1120 -1065 - Sch C - F - E - If you own a business or want to start a business let me merge those to help you through all the new tax laws. Further filing of Forms GSTR-2 and GSTR-3 continues to be suspended.

DEPLETION-- Deductible expense which reflects the decrease of a natural resource due to extraction. 182022Central Tax dated 28th September 2022 with effect from 01 October 20. A corporate name is generally made up of three parts.

The non-resident investor applies the loss and can claim any resulting refund by filing Form T1262 Part XIII2 Tax Return for Non-Residents Investments in Canadian Mutual Funds.

Tax Deduction On Tax And Secretarial Fee 2022 Jan 25 2022 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

Tax Deduction For Secretarial And Tax Filing Fee

List Of Income Tax Relief For Lhdn E Filing 2022 Ya 2021 Iproperty Com My

Simple Tax Guide For Americans In Malaysia

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Tax Return For The Monthly Quarterly Prepayment Of Enterprise Income Tax Applicable To Paying On A Deemed Basis

Tax Deduction Of Secretarial Fees And Tax Filing Fees

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Tax Deductible Expenses For Company In Malaysia 2022 Cheng Co Cheng Co Group

Tax Write Offs For Freelancers Freshbooks Blog

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Tax Write Offs For Freelancers Freshbooks Blog

Due Date For Filing Annual Return Statutory Fee Penalty

2021 Accounting Firm And Tax Practice Cryptocurrency Tax Guide Wolters Kluwer

20 Creative Tax Deductions For Your Small Business Honeybook

Section 179 Tax Deduction How It Works For Retailers 2022 Shopify Indonesia

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Comments

Post a Comment